In accounting, cash flow is a company’s difference in the amount of cash available at the beginning of a period and the amount at the end of the same period.

The cash flow is positive if the closing balance is higher than the opening balance, otherwise is negative.

The cash flow statement is one of the most revealing documents of a company’s financial statements.

It shows the sources and uses of a firm’s cash as it moves both in and out.

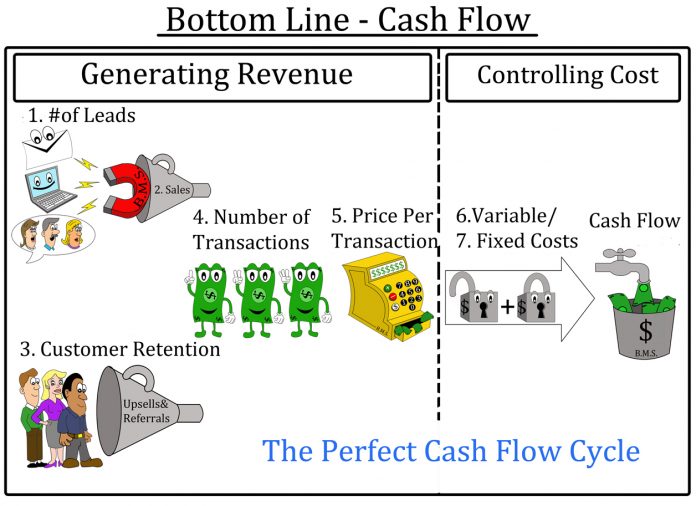

When analyzing a company’s cash flow statement, it is important to consider each of the various sections that contribute to the overall change in cash position.

In many cases, a company may have negative overall cash flow for a given period, but if the company can generate positive cash flow from its business operations, the negative overall cash flow is not necessarily a bad thing.

Cash flow is increased by selling more goods or services, selling an asset, reducing costs, increasing the selling price, collecting faster, paying slower, bringing in more equity, or taking a loan.

The level of cash flow is not necessarily a good measure of performance, and vice versa.

High levels of cash flow do not compulsorily mean high or even any profit; and high levels of profit do not automatically translate into high or even positive cash flow.