Stagflation is a relatively new creature in economic lore, arising for the first time after the Arab oil embargo in 1973 – 1974 that nearly quadrupled prices for crude oil and retail gasoline.

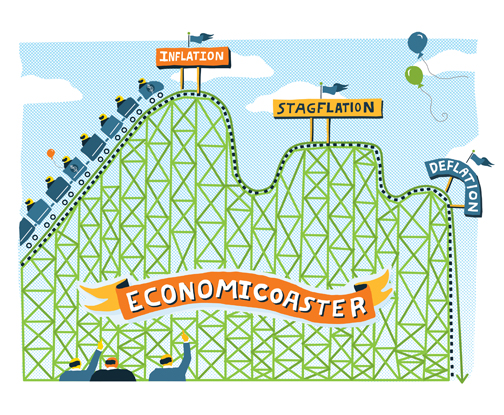

Stagflation is the worst of both worlds – a combination of inflation and recession – and the disease is more difficult to contain than either inflation or deflation alone.

In short, it is characterized by an economy that is contracting while prices keep on rising.

Since 2000, monetary policies have been strongly expansionist.

To fight bear markets and the slowing of GDP, central banks have chosen to inject liquidity in the banking system.

The Fed and the ECB have cut their interest rates and have multiplied and intensified open market operations.

This policy was facilitated by the increase, or the reappearance in the case of the United States, of budget deficits at the federal level.

These policies have done nothing to forestall the advent of stagflation and the theory cannot give us the answer.

In fact, we can see strong hikes in prices and unemployment in several markets.

Keynesian economics suggest that stagflation is impossible because high unemployment lowers demand for goods and services, which lowers prices.

On the other hand, monetarists argue that inflation is due to the money supply rather than to demand and predict that stagflation can occur with inflation and high unemployment if governments increase money supply.