With an automated trading system, you can define specific rules for trade entries and exits that can be automatically executed by a computer.

Once the rules have been established and programmed, the computer can monitor the markets to find buy or sell opportunities based on the trading strategy specifications.

Depending on the specific rules, as soon as a trade is entered, any orders for protective stop losses, trailing stops and profit targets will automatically be generated.

In fast moving markets, this immediate order entry can mean the difference between a winning and losing trade.

Automated trading systems can help minimize emotions throughout the trading process.

Because automated trading allows you to keep your emotions in check, you may have an easier time sticking to your plan.

Also, since trade orders are executed automatically as soon as the trade rules have been met, you won’t be able to hesitate or question the trade.

Because the trade rules are established and trade execution is performed automatically, discipline is preserved even in volatile markets.

Discipline can be lost due to emotional factors such as fear of taking a loss, or wanting to eke out a little more profit before closing a trade.

Automated trading helps ensure that discipline is maintained because the trading plan will be followed exactly.

One of the biggest challenges in trading is to “plan the trade and trade the plan.”

Even if a trading plan has the potential to be profitable, traders who ignore the rules are altering any expectancy the system should have had.

Automated trading systems allow you to achieve consistency because they will always trade the plan.

Since computers respond immediately to changing market conditions, automated systems are able to generate orders as soon as specifications are met.

Getting in or out of a trade a few seconds earlier can make a big difference in the trade’s outcome.

As soon as a position is entered, all other orders are automatically generated, including protective stop losses and profit targets.

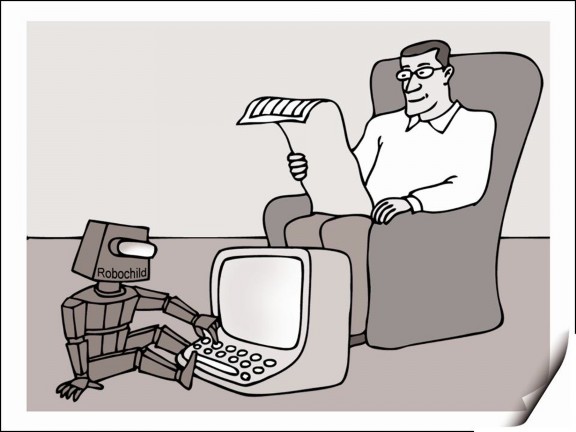

The theory behind automated trading makes it seem simple: Set up the software, program the rules and watch it trade!

In reality, however, automated trading is a sophisticated method of trading that relies on multiple levels of technology.

Depending on the trading platform, a trade order could reside on a computer – and not a server.

What that means is that if an Internet connection is lost, an order might not be sent to the market.

In line with mechanical failures is the need to monitor automated systems.

Although it would be great to turn on the computer and leave for the day, automated trading systems do require monitoring because of the potential for mechanical failures, such as connectivity issues, power losses or computer crashes, and system quirks.

An automated trading system can experience anomalies that could potentially result in unintended, missing or duplicate orders.

If the system is monitored, these events can be identified and resolved quickly.