In investing the market is said to be efficient if it rapidly and completely impounds all relevant information into asset prices.

This is nothing more than saying that Adam Smith’s “invisible hand” of the market place works quickly!

If prices are unfair (i.e. the asset is overpriced) then traders will short the asset, until reduced demand for purchasing it caused the price to fall. The opposite, of course is true for underpriced securities.

This informational efficiency is different than, say, the economic concept of Italian economist’s Vilfredo Pareto efficiency (1848 – 1923), which concerns allocation.

To say that a market is efficient is to make a statement about the speed at which new information filters into the prices!

In order for markets to properly set prices and values, two conditions are necessary:

Willing buyers and sellers, and those same participants possessing perfect knowledge.

Should one side possess more information than the other, then that side has a tremendous advantage. Therefore, the holder of the information can utilize this additional knowledge to extract “undeserved profits.”

Since markets are the very heart and soul of the capitalistic system, the system’s invisible hand not only sets prices, but determines how goods and services are distributed, and encourages further growth of the system with benefits for all.

For markets to work at all, there must be a general feeling that they are fair.

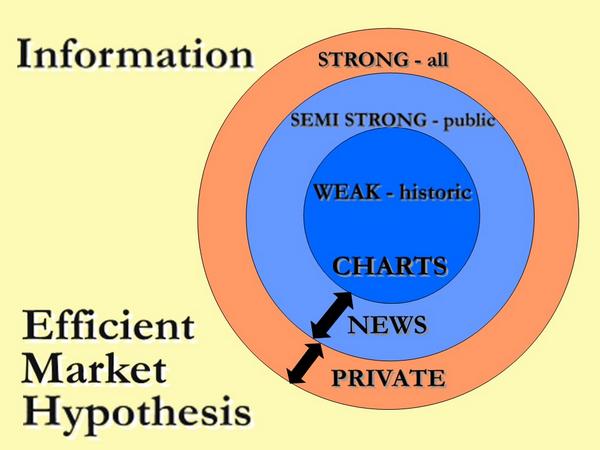

An issue that is the subject of intense debate among academics and financial professionals is the Efficient Market Hypothesis.

This hypothesis states that at any given time, security prices fully reflect all available information.

An “efficient” market is one where there are large numbers of rational, profit-maximizers actively competing with each other and trying to predict future market values of individual securities.

It is a market where current information is freely available to all. In an efficient market, competition leads to a situation where, prices of securities reflect information based both on events that have already occurred and on events which the market expects to take place.

In other words, in an efficient market at any point in time the actual price of a security will be a good estimate of its intrinsic value.

The implications of the efficient market hypothesis are truly profound. Most individuals that buy and sell securities, do so under the assumption that the securities they are buying are worth more than the price that they are paying, while securities that they are selling are worth less than the selling price.

But if markets are efficient and current prices fully reflect all information, then buying and selling securities in an attempt to outperform the market will effectively be a game of chance rather than skill!

But, on the other hand, let’s suppose for the sake of argument that investors, as a whole, are lemmings and markets systematically misprice stocks.

Such a market would surely be an easy game for a smart investor with real analytical skills! But, there’s more than just one smart guy out there! There are thousands of expert analysts looking for over or under-valued securities.

The opportunities to generate excess profits are diminished when these expert investors trade away disparities between price and value.

In other words, a relative few people with little bits of true information determine prices.

The problem is that the smarter and more enthusiastic those few are, the more they ruin things for each other, and the market gets more and more efficient!

The efficient market theory is a good first approximation for characterizing how prices in a liquid and free market react to the disclosure of information. In a single plain word, “Quickly!”

If they did not, then the market is lacking in the opportunism we have come to expect from an economy with traders constantly collecting, processing and trading upon information about individual firms.

The fact that information is impounded quickly in stock prices and that windows of investment opportunity are fleeting is one of the best arguments for keeping the markets free of excessive trading costs, and for removing the penalties for honest speculation!

Speculators always keep market prices close to economic values …

And this is good, not bad!