In early July, a tennis buddy of mine in Colorado, who we’ll call Jim, was leaving the parking lot of his employer, a large defense contractor, when a fellow employee, who we’ll call Bumper, backed out of his parking slot without looking and plowed right into Jim’s car.

Bumper immediately realized he was at fault and apologized. He then said he was late to a meeting and asked to exchange insurance information later.

Since they were both employed at the same company, Jim had them exchange badge numbers, and they agreed to get together the next day in order to take care of insurance matters.

Bumper thanked Jim and again apologized for having caused the accident. Jim also spotted a witness and took down his information.

The next day when the men got together, Bumper’s attitude hardened. Bumper accused Jim of being at fault for the accident. Jim could hardly believe his ears. Why had this nice, apologetic, remorseful fellow employee suddenly turned into such a jerk?

It’s easy: Bumper undoubtedly called his insurance company and found out that Colorado had converted from a no-fault state to a tort state on July 1, 2003.

In a tort state, also known as a fault state, if you are at fault in an accident, you will pay for your own damages and injuries. The insurance companies are there only to protect the innocent parties.

How does this apply in the Jim vs. Bumper case? If Bumper is at fault, he’ll pay for the damage to his car. If he’s injured, he’ll pay for the cost of his medical care. If he’s seriously injured, he’ll spend some time in the hospital.

Have you checked hospital and doctor costs recently? A week-long stay could easily run over $100,000.00. Who pays it? If you are at fault in a tort state and are injured, you do.

Of the 1.2 million bankruptcies filed in the United States in 2001, half were health-related. The trend continued in 2002, with 1,539,111 non-business bankruptcies filed, and just about 50% of them were also health-related.

Don’t be surprised to see figures above 50% in tort states, many cases of which are filed by people who didn’t know the law or the extent of their coverage until it was too late.

Of course, many of the health-related bankruptcies were and are filed by those without health insurance. But plenty of those are filed by those who thought their health insurance was adequate. An accident will quickly acquaint you with the extent of your coverage.

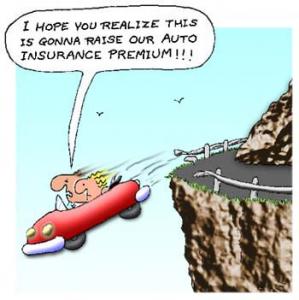

People in tort states generally enjoy lower auto insurance premiums. That’s all well and good, unless you’re in an accident. If you are in a no-fault state, the insurance companies will generally pay the costs involved beyond your deductible. You pay for such coverage in the form of higher premiums.

What should you do? First of all, you should find out if you are in a tort state or a no-fault state. Call your insurance carrier to review the law and the extent of your coverage.

If you have a substantial amount of assets, you’ll want at least $1 million worth of coverage in case you are sued. And you’ll want to talk to your lawyer, since I don’t give legal advice.

If you are in a tort state, you’ll want to check with your insurance company and get a rider on your insurance policy to make sure that at least your medical expenses are covered even if you are at fault. The insurance rider will cost money, but at least you’ll have some protection.

Regardless of which kind of state you’re in, check with your health insurance company to see if you are somehow covered by that policy.

Even if you’re the most careful driver in the world, you could be involved in an accident. A friend of mine lost control of her 4-wheel drive WHILE DRIVING WITHIN THE SPEED LIMIT on an icy road. The vehicle was totaled.

In a tort state, she pays everything! Thank heavens she wasn’t injured. A relative of mine crashed into her own garage when her kids distracted her from the back seat, causing a section of the garage to collapse. Guess who pays for that in a tort state?

So you see, it’s nice to pay lower premiums. It’s not so nice when you realize the consequences.

When You Shouldn’t Call Your Insurance Company!

That’s not a type-o! Example:

You notice a few drops of water forming on your living room ceiling after a heavy rainstorm. What do you do? The same as everyone else: you call up your insurance representative to find out if your leaky roof is covered.

The conversation goes like this:

You: Hi Cindy, this is John Finger. It looks like we have a leaky roof, due to the water spot that formed on my ceiling after last night’s big storm. Can you tell me whether it’s covered under my homeowner’s policy?

Cindy: Sure, John. Let me look it up on the computer. [Pause.] Well, your homeowner’s policy covers your roof only in the event of hail damage. I don’t remember any reports of hail during the storm. Did you get any?

You: No, I don’t remember any.

Cindy: I’m afraid it’s not covered then, John. Sorry.

You’ll have to repair or replace your roof, since normal rain isn’t covered. But you have an additional problem: Cindy is probably required to report the inquiry to her boss. Note that this is just an inquiry, not a claim.

Nonetheless, it is reported. In many cases, inquiries are treated like mini claims and are used against you when the insurance company decides whether to retain you as a customer. Many times you’ll find yourself paying higher premiums just because you have inquired about your policy!

The bottom line here: if you have a general question about your policy, it’s okay to call your insurance company. However, if you are calling regarding a specific incident, look at your policy first.

If you can’t read your policy, get someone who can. Only call your homeowners insurance company about a specific incident if you think you have a valid basis for a claim, and the damage is more than your deductible.

Whenever you are in an automobile accident that’s more than just a fender-bender, by all means call your insurance company, even if you’re at fault.

If it’s just a scratch, and nobody is injured, you may want to call the company anyway, since the other party could always turn into a jerk like Bumper and decide later on that he was injured.

Remember, America is the most litigious society in the world!

The Consequences of Filing A Claim

Let’s go back to the scenario above, where you called your agent about the leaky roof. She asked you about hail damage. The thought may have crossed your mind that it would be a good idea to claim hail damage, even if you didn’t think you had hail damage.

At first, the company will probably be courteous about it and do all they can to help. They’ll send out an adjuster to look at the roof and inspect for hail damage. The adjuster will likely tell you that there’s no evidence of hail damage, and your claim will be denied.

This will go into your file. Your insurance company may decide to either raise your rates or decline you altogether, even if you thought you had a legitimate claim.

The adjuster has to be paid, too, so just think of your claim as being one of many. When companies have to send adjusters all over the place, the policyholders have to pay for it in the form of higher premiums.

If you decide to fake evidence in order to make your claim, you would be joining the $80 billion-per-year insurance fraud racket.

According to USAA Magazine, 10% of all property insurance claims are fraudulent, and 36% of bodily injury claims are fraudulent.

Included in the fraudulent category are “padded” claims, whereby the base claim is legitimate, but the claimant tacks on a few bucks in order to get a bigger check from the insurance company.

Most insurance companies have specialists who work this field. When they suspect fraud, companies will notify police. Then the claim you file may be paid somewhat differently: with handcuffs, free room and board, and special entertainment from Bubba in Cellblock C.

Even legitimate claims can compromise your ability to retain coverage. A Realtor friend of mine with multiple properties was cut off after he filed just two claims in five years.

Yours truly also has experience in this area: vandalism at one of my houses caused several thousand dollars in damage. The insurance company paid the claim and declined to renew my policy.

My replacement coverage cost nearly three times as much. And here’s a tip for those of you who own multiple properties: claims are filed by Social Security Number.

If you file a claim for damage at one of your properties, you can expect your rates to increase everywhere, that is, if the company doesn’t terminate your coverage. Keep this in mind if you’re thinking about becoming a landlord.

If you rent your home, you may think this discussion doesn’t apply to you. You’re sorely mistaken. Owners must pass on the costs of owning the property to you, the renter.

Otherwise, they lose money and can’t stay in business. If the owner’s insurance rates go up, so will your rent. Moreover, renters need renters insurance, because the owner’s policy generally won’t cover the renter’s possessions.

Plenty of renters file fraudulent claims, and this will drive up the cost of your renter’s policy. Nobody can hide from the costs of insurance fraud.

Why are insurance companies getting more stringent in their coverage and charging more for the privilege of insuring with them?

A few reasons exist. The biggest one is 9/11. Before that date, insurance policies generally had no provision for terrorism coverage.

As a result, they got stuck with billions of dollars in claims. For example, Warren Buffett’s Berkshire Hathaway had to fork over about $2 billion in 9/11-related claims. Now policies have a terrorism rider: either you pay for it, or it’s excluded.

Another reason is the trend of natural disasters. We’re seeing more tornados, hurricanes, droughts, fires and other calamities.

A third reason is fraud on behalf of policyholders. Every person who files a false or padded claim causes the next person to pay higher premiums.

An insurance company is a business: if revenues don’t support expenses plus a profit, it’s hasta la vista for the insurance company.

If there’s one silver lining in all this, it’s that people will now think twice before filing claims or even inquiring about their policies.

An insurance company is there for you to make legitimate claims and to answer questions. Don’t treat it like a piggy bank.

So what was the outcome of the Jim vs. Bumper case?

Jim e-mailed me this update just before we went to press: “I had to give taped testimony to his insurance company. They tried lots of different angles and questions to “snare” me.

“Where were your eyes while you were driving?” I replied, “Straight ahead.” Their comment back was, “So you weren’t necessarily looking for traffic entering from the left or right …”

In the end, their adjuster came out and looked at the car. It was clear that:

A. I was not driving fast (the scrape on the car was only five feet long) and

B. That he backed up squarely into the middle of my car i.e. I was already behind him when he backed up.

The adjuster believed my story at this point and decided to cover 100% of the costs to repair my car.

Jim added a conclusion, which is best left as he sent it to me:

“Just because someone works for the same company doesn’t mean they aren’t a jerk. Always get the names and numbers of witnesses and never assume that the other guy is going to be honest, cooperate and not lie to serve his own interests.”

In Part by The Money Management Firm, Inc.

www.moneymanagementfirm.com