Subprime loans, also called “B” loans or “second chance loans” are loans originated to borrowers who do not qualify for market interest rates because of problems in their credit history.

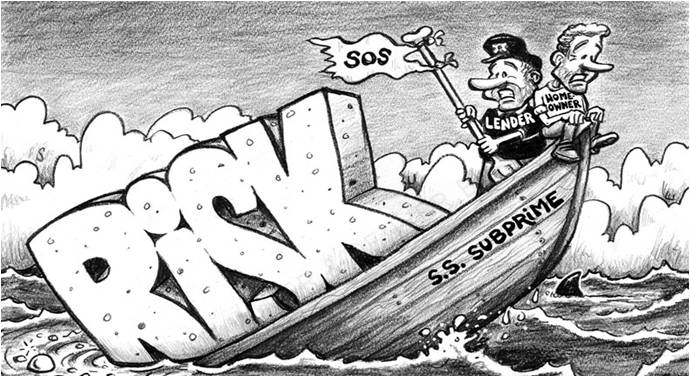

Subprime loans are generally considered risky for both the borrower and the lender.

It’s risky for the lender because borrowers usually have lower incomes and a poor record for paying debt, which increases their default probability.

It is also extremely risky for borrowers.

To offset the risk of defaults, lenders will charge high rates of interest to offset the risk. The high interest rates however are strenuous for borrowers which further increases their likelihood of default.

Subprime loans were created with the realization that a lot of money could be made to borrowers with poor credit who could not get conventional loans.

Conventional lenders would not take the risk to lend to people with credit scores below the firm threshold.

This opened many opportunities for subprime lenders to lend to people with below acceptable credit scores.

21% of mortgage applications between 2004 and 2006 were subprime compared to 9% between 1996 and 2004.

Subprime mortgages reached a record of US$ 805 billion in 2005. In 2006 they totaled approximately US$ 600 billion.

There are various different types of subprime mortgages including “interest only mortgages,” which allow borrowers to only pay interest for a period of time, “pick a payment,” which gives the borrower the option on how to repay the loan and “initial fixed rate mortgages,” which convert to variable rate loans.

The subrime story begins with borrowers who have a poor credit history looking to buy a house and are prepared to pay a mortgage rate typically 2% higher than rates charged to people with good credit.

Borrowers approach mortgage brokers or conversely get brokers to cold call them.

Brokers handle approximately 70% of the origination.

Brokers match prospective borrowers with lenders who further lure borrowers with exotic mortgages such as “no doc” mortgages, which do not require any evidence of income or savings.

Big banks and wholesale lenders buy the debt, repackage them and sell them to Wall Street firms.

Wall Street banks and investment houses further repackage these loans in mortgage backed securities (MBS) and collateralized debt obligations (CDO).

These structured products very often yield high rates of return and are sold to pension funds, hedge funds and institutions.

Many economists are blaming the crisis on exuberant brokers who lure borrowers into mortgage deals.

These borrowers very often do not understand the types of loans or the contracts they sign, which denies the ability to asses true risk.

The problem includes appraisers using inflated figures to value houses.

Lack of government regulation has also been blamed as being the cause of the problem.

Subprime lenders naturally foreclose on properties at a much higher rate than conventional lenders.

Statistics show that approximately 3.3% of subprime loans end up in foreclosure compared to 1.1% for conventional loans.

The subprime meltdown is said to have begun in 2006, with escalating number of subprime house foreclosures.

The relationship between subprime meltdown and house prices is as follows:

As house prices drop, the equity value of home mortgages goes down, this creates an increase in mortgage defaults which will cause a further drop in house prices.

This positive feedback relationship will simply create a snowball effect until the economy has reasons to believe that there are reasons for the reverse to happen.

The subprime problem could also seep into other sectors in the economy.

The housing slump is estimated to be able to strip 1-2 points off the GDP figure, furthermore, the downturn in the housing market will drag down the construction sector which will further affect other industries like i.e. plumbing, furniture and home improvements.

The FED responded to the crisis by prescribing methods to regulate the mortgage industry and enhancing laws where high levels of due diligence is needed in assessing borrowers ability to pay as well as make sure there is a much clearer understanding on the terms of the loans.

These guidelines were put forth with the hope to prevent or at least reduce fraud and abusive lending in the future.